As the market continues to shift beneath our feet, dealers are looking for any edge to drive sales. In this age when the digital experience is so tightly blended with an in-store experience, there are several process opportunities to harness information, accuracy and transparency to improve sales operations.

Dealers are getting more surgical with their use of soft pull tools online and in-store. Soft pull even came up during CarMax’s last earnings call*, so let’s explore its importance.

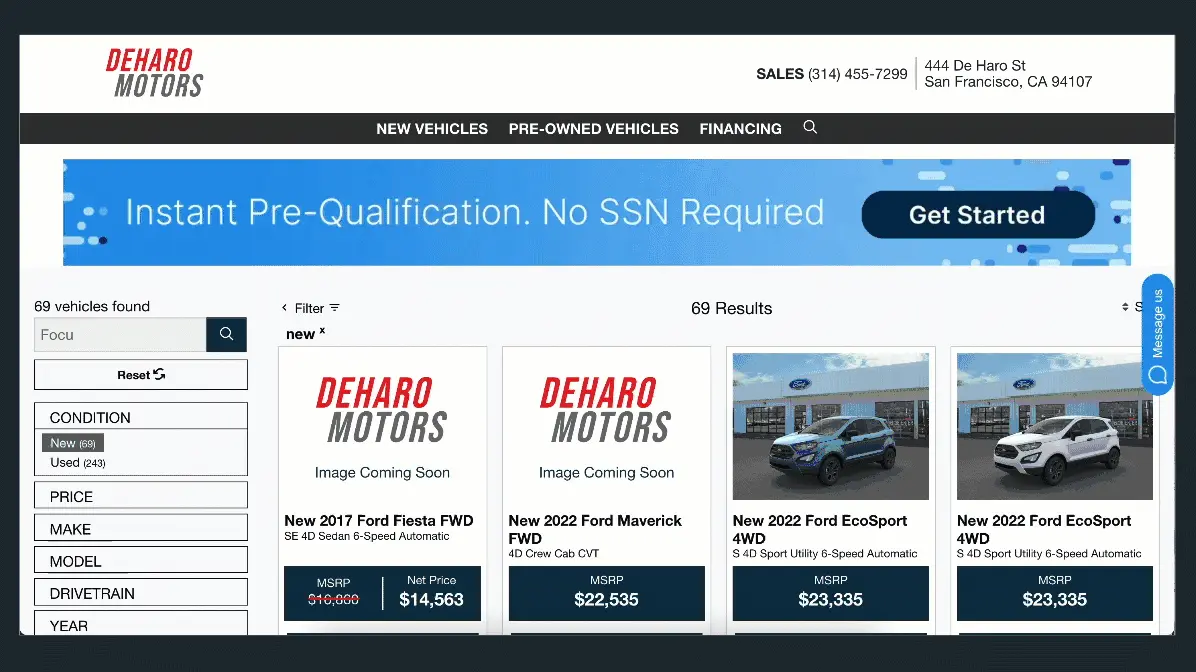

Make it easy for your online shoppers to get pre-approved

Intuitively we know that our online shoppers want to do more. The most recent Cox Automotive Finance Study** confirms this, finding that 87% of respondents research financing online prior to purchasing. But the same study also found that only 24% applied for financing online. What does this tell us?

Shoppers want to dip their toes into the financing process to understand affordability, but almost 80% of those online shoppers don’t submit a full app. Shoppers want to understand their creditworthiness, without the time and commitment of a full credit application. As a dealer with Soft Pull, you can meet these customers where they are. Your dealership should market the daylights out of this convenience.

Quarterback your busy showroom with soft pulls

As Managers at the desk, we have to create order and operationalize the sales process. This means getting F&I to the credit challenged-shoppers early, ensuring that the green pea doesn’t land a customer on a vehicle that’s too expensive, and getting the right information to the desk at the right time.

Incorporating a soft pull into your process can jumpstart additional important processes:

- Reveal credit on the bubble. Now F&I managers can pre-interview and lean in before the app to be proactive

- Reveal a great credit score but a lack of any installment history. Estimate payments at mid-level rates, to ensure expectations are set

- Revealing exceptional credit. Use the most efficient lender decisioning portal to get an ink-ready fundible deal into your RouteOne with an upward-facing green arrow for immediate econtracting

Soft pulls are not just for online shoppers. Improve how you sell to customers with actionable intelligence that gets more deals across the line faster, and keeps you in control.

Re-Energize your service-to-sales experience

With supply so tight, we’ve improved our service-to-sales processes. At this point, we’ve mailed, emailed, and appraisal-staple-to-ROs our service customers to the point of exhaustion. As an owner of two nearly-new, low-mileage cars from two different brands, I get more mail/calls/email about my old cars and what they are worth than you’d believe.

Differentiate your messaging with an “easy” theme, and make it less about their old car and more about how your “PreQualification” will make buying their next car… easy.

Nurture online soft pulls more deeply into your funnel

While soft pull is powerful, and has a ton of intelligence, it isn’t the end game; it’s the beginning of a deal. Ensure that your soft pull is part of a larger platform helping shoppers dip their toes, get comfortable, and then be nurtured to do more.

At AutoFi, our platform connects all parts of the digital experience to

- Eliminate duplicate lead forms

- Get shoppers into our deal platform to become buyers

- Drive buyers to the application

- Provide you with line-of-sight in our connected platform

Pre-qualification using soft pull can level up your online and in-store operations, driving greater engagement with your customers in your online credit application and buying platforms.

—

Patrick Wyld is Director of Training at AutoFi