Are you taking full advantage of the AutoFi platform to increase your profitability? Check out a few of the AutoFi features and capabilities—including custom rate sheets, smart lender routing, and F&I product presentation, that can help you increase your back-end profit:

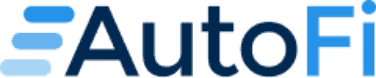

Custom Rate Sheets

Dealers are always looking for ways to present deals that gets the customer’s attention while preserving profits. Custom rate sheets help dealers to configure custom rates for different scenarios—to potentially offer a lower rate or a higher rate than what is available from the lender. These custom rates can be configured to take precedence over the best rate available from the lender, giving the dealer more control than ever before.

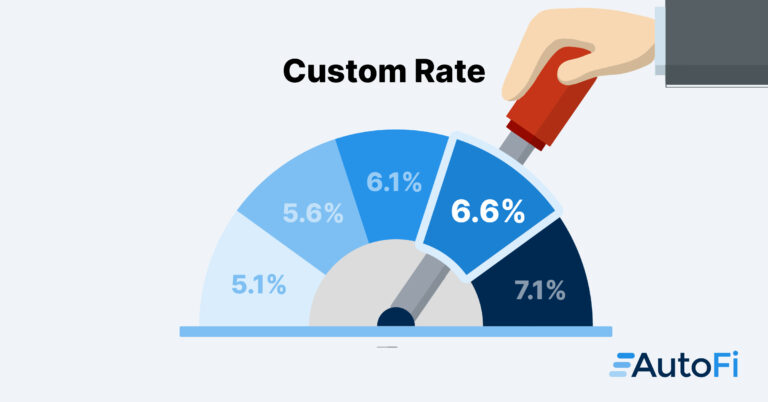

Smart Lender Routing

Taking a one-size-fits-all approach to lender selection doesn’t work in your F&I Office, so why would it work on your digital platform? AutoFi offers smart lender routing, where we work with your management to define a custom lender routing algorithm based on the customer credit profile, lender criteria and your dealership strategy. This allows your digital customers to get the same level of expert lender selection your F&I Manager provides in store—ensuring lenders are presented to customers optimized for conversion and profit.

F&I Product Presentation